We Help You Launch Loan Services Business In Matter Of Minutes. No Need For Loan Expertise Or Running Behind Banks For Tie-Ups.

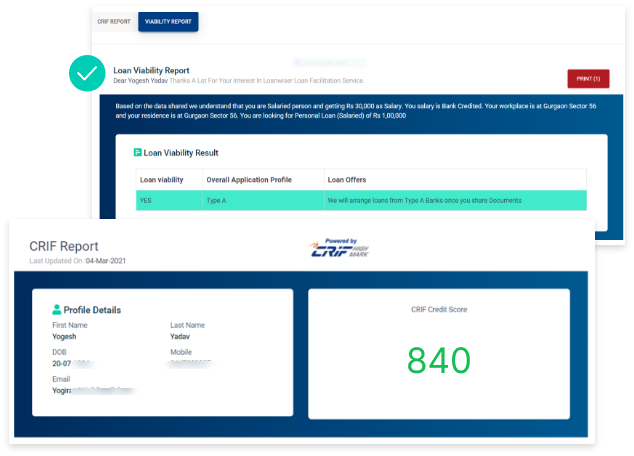

We have simplified the journey of starting a loan business by building a revolutionary loan sourcing platform and by partnering with 40+ banking partners, who offer wide range of loan products. Our system does an automatic profile analysis and suggest document requirements based on applicant's profile. We also have dedicated loan executives who will take care of customer verification, match making and following up with banks till disbursement. All process are kept transparent, updated live in our state of the art Loanwiser platform.

Zero Investment Cost - 100% Free Platform | Guaranteed Cash Earnings + Percentage for every loan disbursed

Request Demo