Revolutionizing The Way Banks Reach Out To The Bharat!

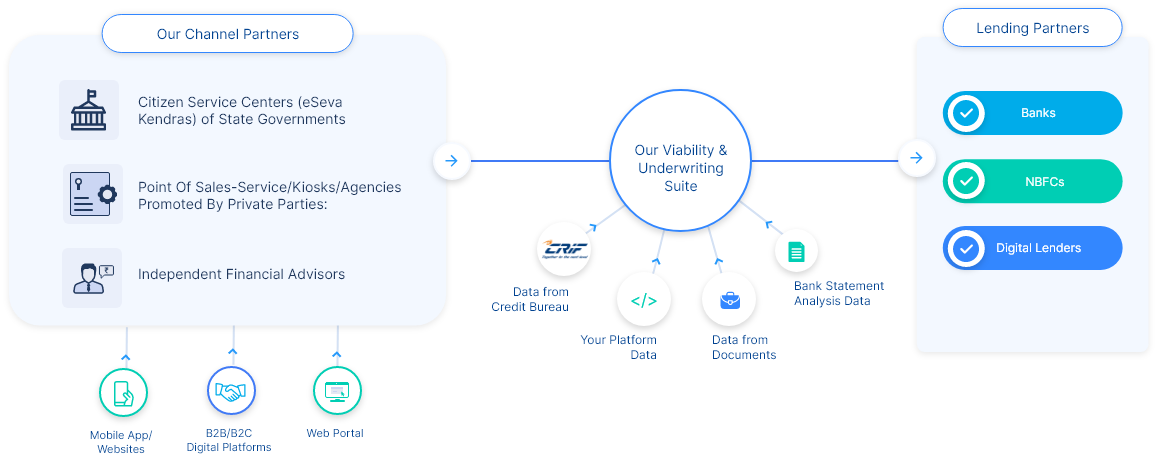

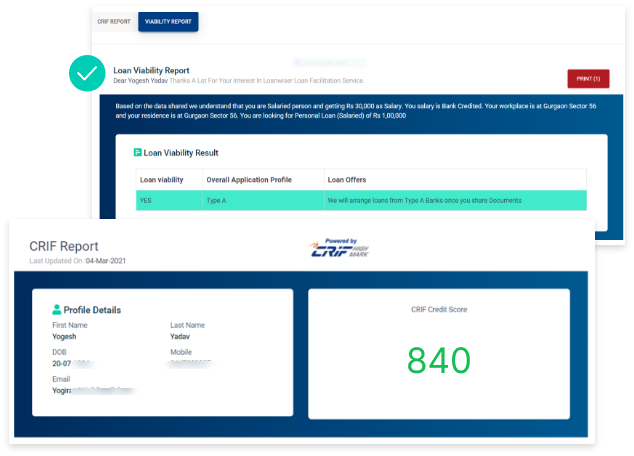

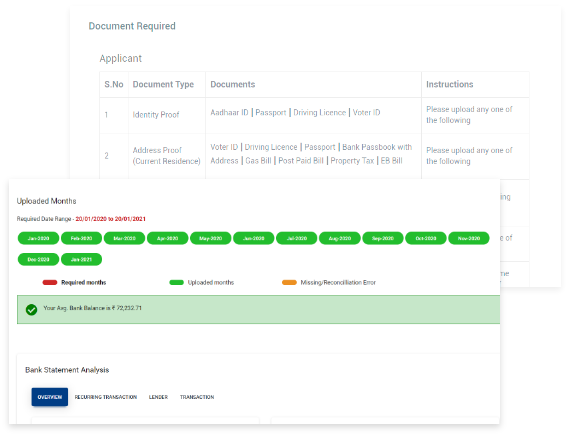

Source qualified leads, Introduce specialized products, Run customized marketing campaigns - All on a zero investment, just by partnering with us.

You no longer need to have a physical presence or dedicated sales persons to serve the most underserved segment of India, We have established a strong network of partners through our unique assisted digital model, You just have to leverage it.

Request Demo